The market conditions of passive components in 2021 can be expected. The legal person estimates that next year’s global passive component output value is expected to grow by about 11.1%, the capacity expansion will be about 10%, and the demand will grow by about 15%. It is estimated that MLCC and chips will be in the second and third quarters of 2021. There is a chance for resistance quotes to increase.

Looking ahead to the passive component market in 2021, local legal entities report that, benefiting from the increased penetration of 5G smartphones, electric vehicles (EV) and automotive electronics, it is expected that the global passive component output value is expected to grow by approximately 11.1% annually in 2021.

From the perspective of capacity expansion, the legal person estimates that global passive component production capacity will continue to expand in 2021, with an estimated expansion rate of about 10%.

In terms of product prices, the legal entity expects that the demand for passive components in 2021 will slightly exceed the growth of supply, with an annual growth rate of about 15%. It is estimated that the quotations of multilayer ceramic capacitors (MLCC) and chip resistors (R-chip) have a chance to be in 2021. The second and third quarters were adjusted up again.

In terms of the number of mobile phones used, the legal person said that the average passive component usage of a 4G smartphone is about 750 to 800, and the usage of 5G mobile phones will increase to more than 1,000, an increase of 20% to 30%.

In the automotive electronics sector, due to the significant increase in demand for automotive entertainment systems, advanced driver assistance systems (ADAS), and Internet of Vehicles, as well as the drive of electric vehicles, automotive electronics accounted for a significant increase in the proportion of components in vehicles and electric vehicles from this year At 35% and 50%, MLCCs, resistors and capacitors are the key components of automotive electronics and are expected to benefit from this trend.

Observing the orders and utilization rate of Taiwan factories, Yageo pointed out a few days ago that the utilization rate of the group is slowly increasing, but recruitment is still not easy. The current utilization rate is about 80%, and it continues to slowly climb above 80%.

Yageo stated that orders before the Lunar New Year in 2021 are in order, but the overall situation in 2021 is still unclear. Some orders are longer-term, and the group tries to rush to meet customer needs.

In terms of product inventory days, Yageo pointed out that there is no chance to make up before the Chinese New Year in 2021, and inventory days are still low.

Huaxin Technology recently pointed out that the order visibility can be seen for 3 months, and the average utilization rate of products including MLCC and chip resistors maintains 90% high-end.

Observing the product inventory days, the inventory days of Huaxinke passive components are below 45 days, and the normal water level is about 2 months, indicating that the current inventory level is low.

The legal person pointed out that Yageo is the world’s third largest MLCC supplier and the world’s largest supplier of chip resistors.

Global MLCC manufacturers include Japan’s Murata Manufacturing Co., Ltd., South Korea’s Samsung Electric, Taiwan’s Yageo, Japan’s Taiyo Yuden, and TDK, AVX, etc. Chinese manufacturers include Yuyang Technology, Fenghua Hi-Tech, Sanhuan Group, Torch Electronics, Microcapacity Electronics, etc. Global chip resistor manufacturers include Yageo, Housheng, Huaxinke, Dayi, Fenghua Hi-Tech, Rohm, KOA, Panasonic, Vishay, etc.

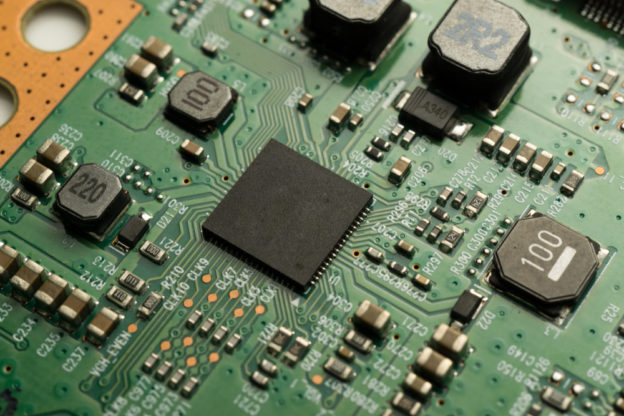

(Author: Zhongrong Feng; first map Source: shutterstock)